Estar al día con las ultimas noticias de facturación nunca fue tan fácil

ULTIMAS NOTICIAS DE FACTURACIÓN

El aliado de los contribuyentes mexicanos con las ultimas noticas fiscales y de facturación

» Publicaciones recientes

-

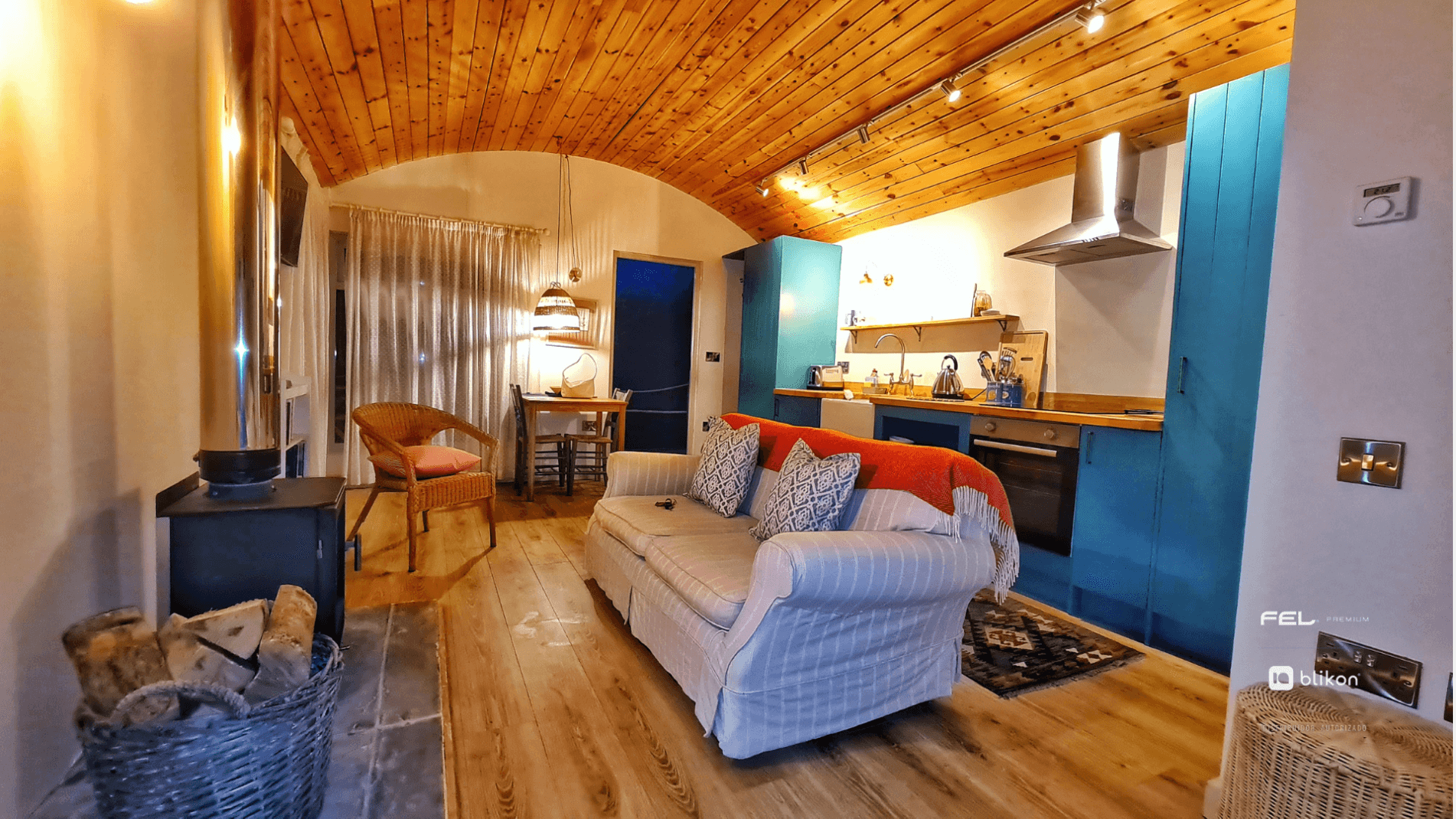

Plataformas de Hospedaje, ¿Cómo declarar al SAT?

Si ofreces servicios de hospedaje en plataformas digitales como hoteles, >

-

%27%20fill-opacity%3D%27.5%27%3E%3Cellipse%20fill%3D%22%23f8ffff%22%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(816.7456%20-41.37455%206.42693%20126.86956%20341.4%20649)%22%2F%3E%3Cellipse%20fill%3D%22%23003675%22%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(371.61035%20186.04939%20-104.51217%20208.74997%20693.7%20179)%22%2F%3E%3Cellipse%20fill%3D%22%23452a10%22%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(129.7385%20-9.75509%2023.90468%20317.922%2060%20116.7)%22%2F%3E%3Cellipse%20fill%3D%22%233e80c0%22%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22rotate(103.7%2036.4%20328.6)%20scale(269.20773%20144.79812)%22%2F%3E%3C%2Fg%3E%3C%2Fsvg%3E)

Pago o retención del IVA en el RESICO

El Régimen Simplificado de Confianza (RESICO) es un esquema implementado >

-

%22%20transform%3D%22translate(1.6%201.6)%20scale(3.20703)%22%20fill-opacity%3D%22.5%22%3E%3Cellipse%20fill%3D%22%23600000%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(-73.28063%20-11.34444%208.30434%20-53.64276%20203.6%20187.5)%22%2F%3E%3Cellipse%20fill%3D%22%23d5e8b6%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(25.3817%2029.0496%20-192.0272%20167.78126%2068%2063.4)%22%2F%3E%3Cellipse%20fill%3D%22%23da8043%22%20cx%3D%2299%22%20cy%3D%22136%22%20rx%3D%2238%22%20ry%3D%2263%22%2F%3E%3Cpath%20fill%3D%22%238c9fb7%22%20d%3D%22M269.2-.1l-7.6%20108.7-120.8-8.5%207.6-108.7z%22%2F%3E%3C%2Fg%3E%3C%2Fsvg%3E)

Cambios en la Segunda Modificación a la Miscelánea Fiscal 2024

El Servicio de Administración Tributaria (SAT) ha introducido importantes cambios >

-

%22%20transform%3D%22translate(1.6%201.6)%20scale(3.20703)%22%20fill-opacity%3D%22.5%22%3E%3Cellipse%20fill%3D%22%23ddd%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(13.79036%20-54.83107%2091.51574%2023.01678%2032.2%20191.6)%22%2F%3E%3Cellipse%20fill%3D%22%231f1f1f%22%20cx%3D%22255%22%20cy%3D%2239%22%20rx%3D%22135%22%20ry%3D%22135%22%2F%3E%3Cellipse%20fill%3D%22%23dedede%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(-38.75855%20-5.70478%207.76377%20-52.74747%2017.2%2028.8)%22%2F%3E%3Cellipse%20fill%3D%22%239c9c9c%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(34.35605%20-96.48299%2045.05314%2016.0427%2023.2%2066.9)%22%2F%3E%3C%2Fg%3E%3C%2Fsvg%3E)

Ley Antilavado, operaciones bajo escrutinio

La Ley Federal para la Prevención e Identificación de Operaciones >

-

Pago provisional PM, ¿Qué facturas considera el SAT?

El proceso de prellenado en las declaraciones de pago provisional >

-

REPSE, Requisitos para deducir CFDI de nómina

Con la reforma a la subcontratación en México, las empresas >

-

%22%20transform%3D%22translate(1.6%201.6)%20scale(3.20703)%22%20fill-opacity%3D%22.5%22%3E%3Cellipse%20fill%3D%22%23060606%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(39.66751%20-42.68733%2048.59224%2045.1547%20216.9%2017.7)%22%2F%3E%3Cellipse%20fill%3D%22%23fff%22%20cx%3D%22153%22%20cy%3D%22213%22%20rx%3D%22121%22%20ry%3D%22121%22%2F%3E%3Cellipse%20fill%3D%22%23292929%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(32.54035%2024.09297%20-56.9261%2076.8853%2074%2026.7)%22%2F%3E%3Cellipse%20fill%3D%22%23e5e5e5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(253.31458%2029.26985%20-4.0715%2035.2366%2087.2%20168.2)%22%2F%3E%3C%2Fg%3E%3C%2Fsvg%3E)

Errores comunes al realizar la deducción de inversiones

La deducción de inversiones es un beneficio fiscal que permite >

-

%27%20fill-opacity%3D%27.5%27%3E%3Cellipse%20fill%3D%22%23545a58%22%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(-36.01043%20-173.6234%20239.7669%20-49.72895%2077.7%20408.3)%22%2F%3E%3Cellipse%20fill%3D%22%23f8fdfc%22%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22rotate(3.6%20-5335.5%2011921.4)%20scale(116.16231%20817.7929)%22%2F%3E%3Cellipse%20fill%3D%22%23d36489%22%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(-6.72327%2097.1782%20-140.76134%20-9.73857%20539.2%20231.8)%22%2F%3E%3Cellipse%20fill%3D%22%23f4f9f8%22%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(171.19901%20-231.10638%20142.93102%20105.88046%20409%20664.3)%22%2F%3E%3C%2Fg%3E%3C%2Fsvg%3E)

Conoce los requisitos para deducir los pagos en especie

En México, no todas las transacciones comerciales o financieras implican >

-

%22%20transform%3D%22translate(1.6%201.6)%20scale(3.20703)%22%20fill-opacity%3D%22.5%22%3E%3Cellipse%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22rotate(-133.2%20138%2053)%20scale(87.13186%2054.10937)%22%2F%3E%3Cellipse%20fill%3D%22%23fff%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22rotate(141.9%20102.7%2061.4)%20scale(63.96484%2082.7237)%22%2F%3E%3Cellipse%20fill%3D%22%23f7f7f7%22%20cx%3D%2227%22%20cy%3D%2299%22%20rx%3D%2268%22%20ry%3D%22170%22%2F%3E%3Cellipse%20fill%3D%22%23fff%22%20cx%3D%22232%22%20cy%3D%2233%22%20rx%3D%2263%22%20ry%3D%2263%22%2F%3E%3C%2Fg%3E%3C%2Fsvg%3E)

¿Gastos por cuenta de terceros aplica a viáticos?

El esquema de gastos por cuenta de terceros se refiere >

-

IVA de los Gastos no deducibles

Cuando se trata del IVA, uno de los puntos clave >

-

%27%20fill-opacity%3D%27.5%27%3E%3Cellipse%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22rotate(78.3%208.7%20156.3)%20scale(179.20478%20249.79815)%22%2F%3E%3Cellipse%20fill%3D%22%23dfdfdf%22%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(-553.46264%20-63.96511%2027.75179%20-240.12429%20498%20577.4)%22%2F%3E%3Cellipse%20fill%3D%22%23111%22%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(80.73857%20173.3909%20-128.7052%2059.9309%20768.4%20127.7)%22%2F%3E%3Cellipse%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(-207.91404%2056.489%20-35.1152%20-129.2454%20107.2%2086.7)%22%2F%3E%3C%2Fg%3E%3C%2Fsvg%3E)

¿Conoces los principales medios de defensa fiscal?

Los medios de defensa fiscal permiten a los contribuyentes impugnar >

-

%27%20fill-opacity%3D%27.5%27%3E%3Cellipse%20fill%3D%22%23150000%22%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(-186.75014%20163.29376%20-154.97775%20-177.23958%20755.7%20458.8)%22%2F%3E%3Cellipse%20fill%3D%22%23c5d2db%22%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22rotate(86.1%20157.4%20229.3)%20scale(213.44604%20386.72791)%22%2F%3E%3Cellipse%20fill%3D%22%23cf6f21%22%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22matrix(-8.40471%20-133.58911%20425.5662%20-26.77436%20294.6%20641.5)%22%2F%3E%3Cellipse%20fill%3D%22%23b8bec4%22%20fill-opacity%3D%22.5%22%20rx%3D%221%22%20ry%3D%221%22%20transform%3D%22rotate(109.9%2030%20221.7)%20scale(233.75009%20123.60385)%22%2F%3E%3C%2Fg%3E%3C%2Fsvg%3E)

¿Cómo encontrar la clave de tu producto o servicio en el SAT?

El catálogo de productos y servicios del SAT es una >

Escucha más con los ojos que con los oídos

Suscríbete y recibe cada semana en tu correo:

![]() Noticias fiscales frescas con puntos clave.

Noticias fiscales frescas con puntos clave.![]() Casos prácticos para facturar en línea fácil.

Casos prácticos para facturar en línea fácil.

Todo claro, actualizado y sin complicaciones, te lo lees en menos de 5 minutos.

PD. Un correo semanal te mantiene al día sin spam, si quieres suscríbete.